Context of use of Cube Platform

An authorized External Advisor, advising clients on their portfolios deposited with custodian banks

Company functions involved

Front Office, Back Office

Back Office Functions

- Download positions and transactions from custodian bank

- Manual input of bank transactions and positions

- Reconcile bank transactions with client approved advice

- Upload financial instrument EMTs

- Manage database of financial instruments

- Calculate performances

- Calculate fees

Advisor Functions

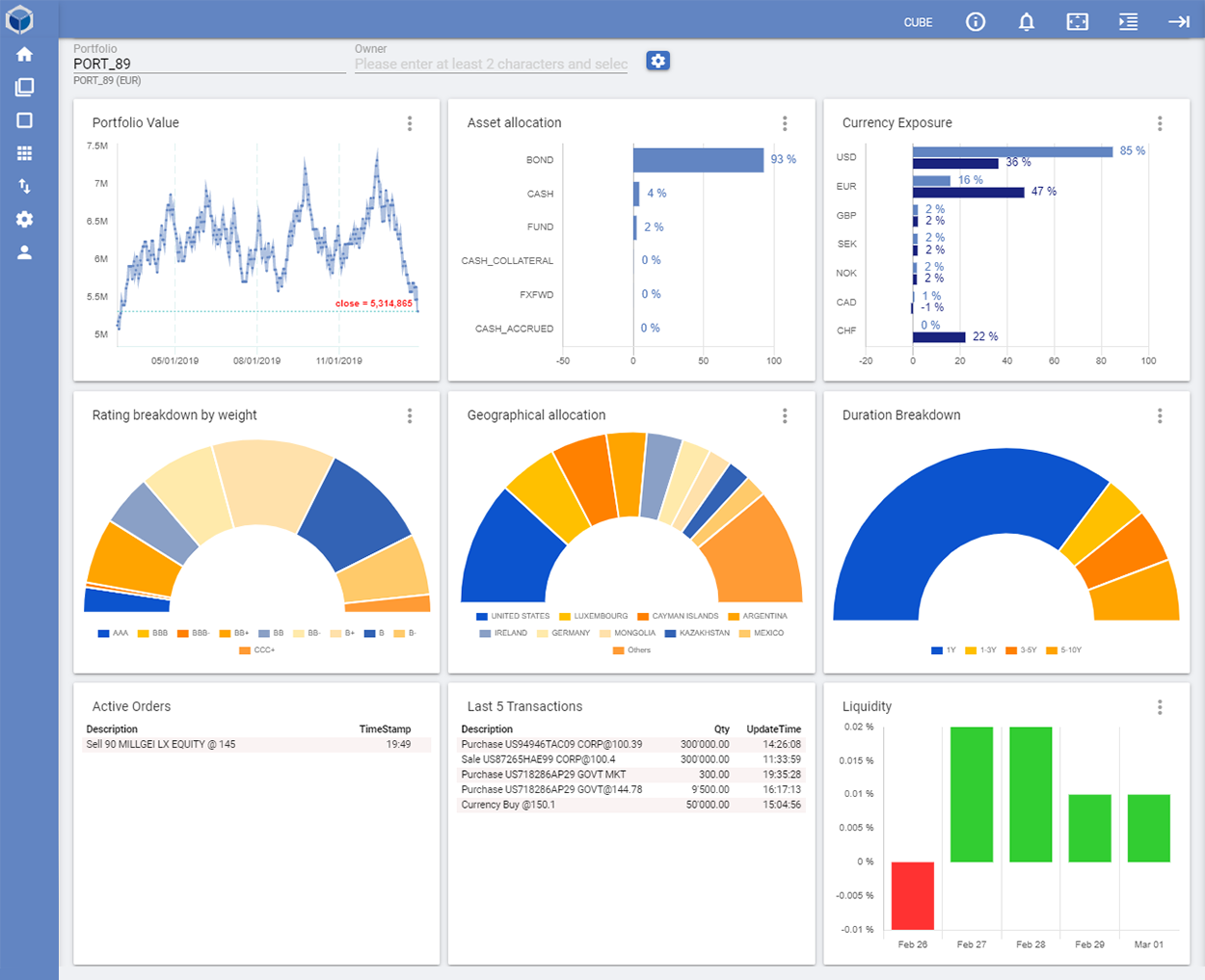

- View portfolios

- Analyze portfolio risks

- Generate reports

- Generate investment proposals

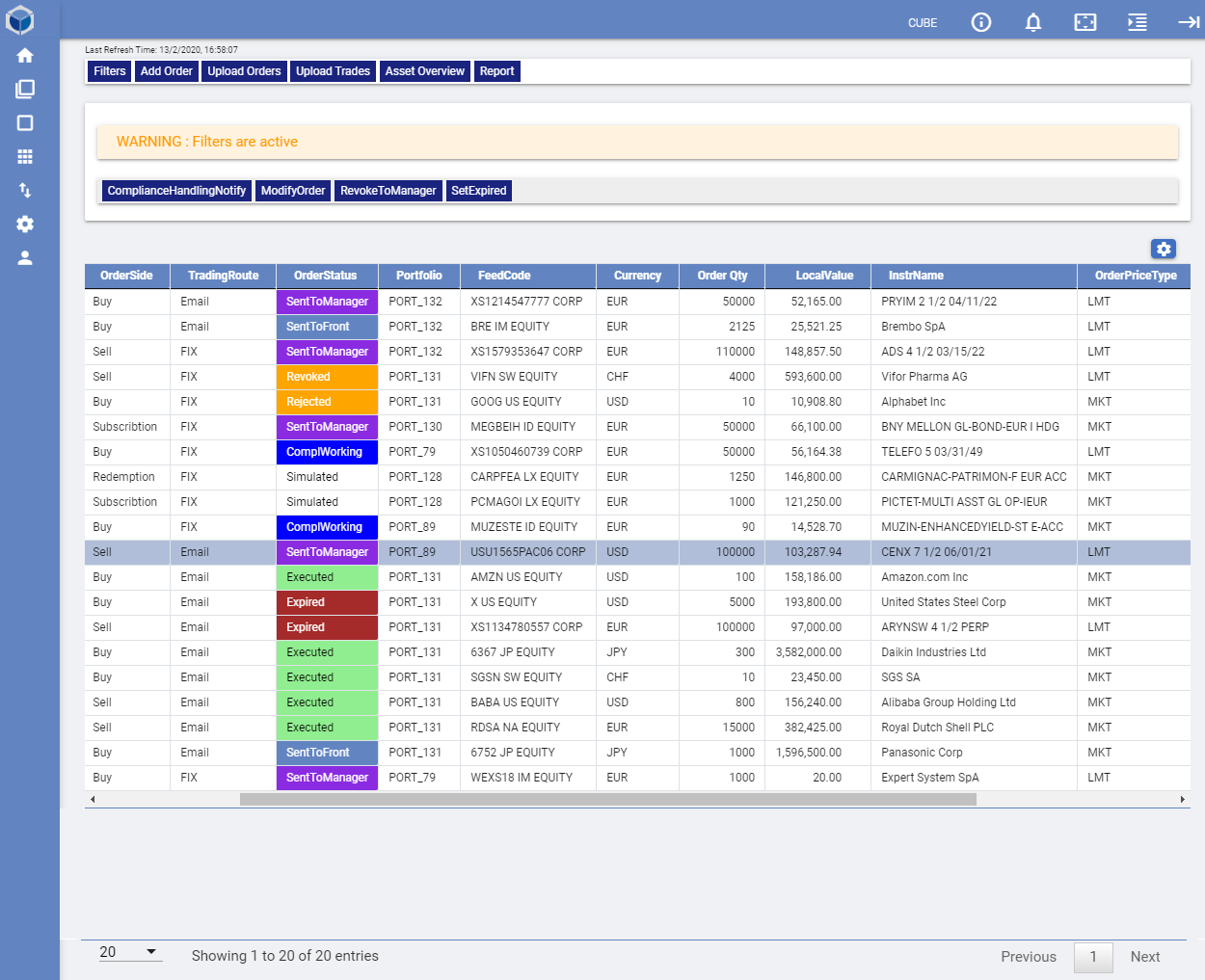

- View Order Book of advisory activity

CRM functions

- Profile prospect clients: KYC, AML, PEP, etc

- Create and manage Risk Profile questionnaires

- Calculate the client Risk Scoring

- Create and calculate client risk profiles according to MiFID and FINMA

- Assign Portfolio Management line based on Risk Profile scoring

- Manage client exceptions to Portfolio Management line

*Note: functions as shown above are typical of larger or more structured organizations. However, the User / Role /Restrictions matrix enables the creation of any number of roles based on e.g. internal or regulatory directives, company size, “chinese wall” requirements, etc.