Context of use of Cube Platform

A single or multi Family Office tasked with overseeing and managing the total wealth of UHNW families, including illiquid assets.

Company functions involved

Wealth Manager, Front Office, Back Office, CRM

Wealth Manager Functions

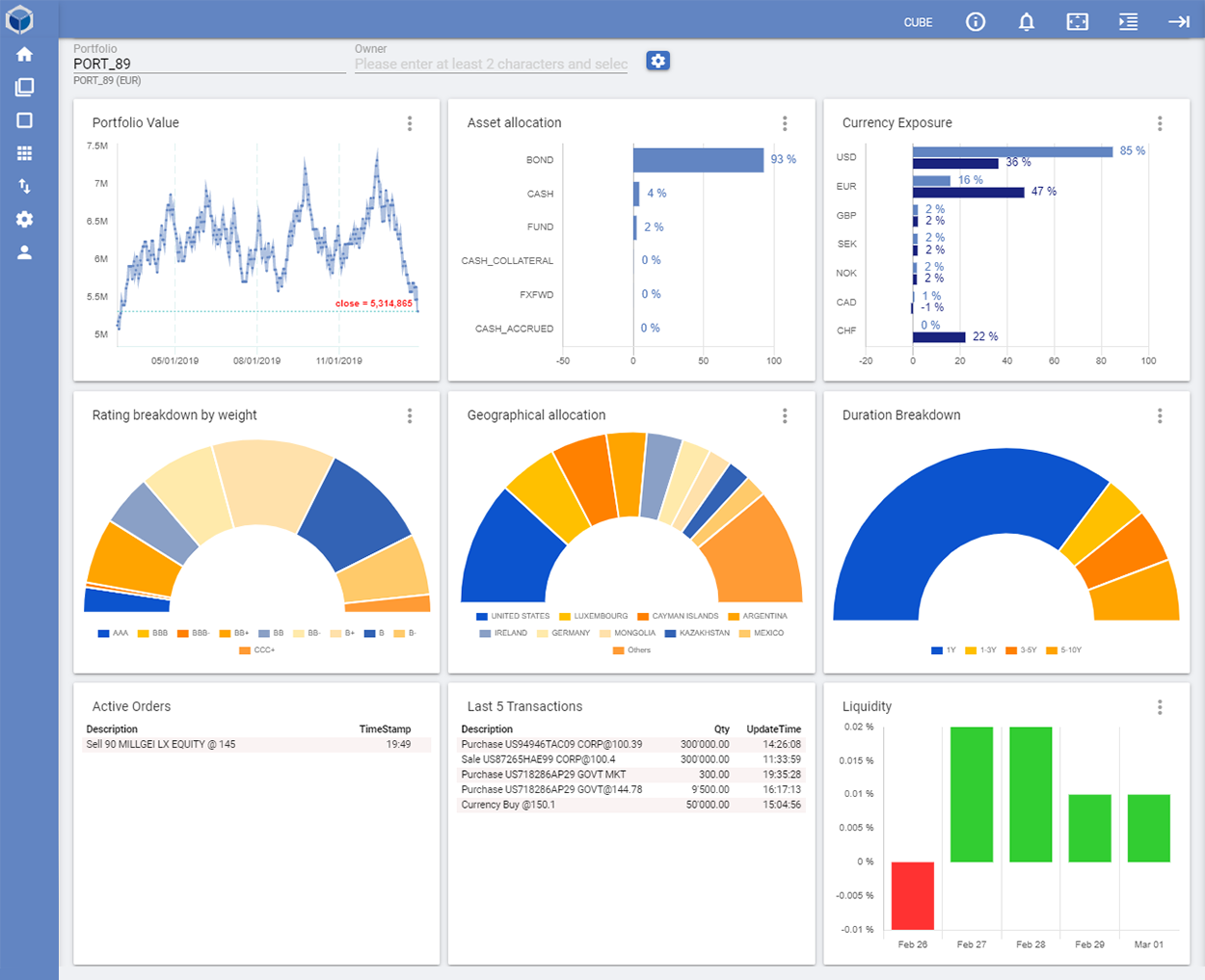

- View consolidated reports

- Multi level aggregation according to e.g. family members, asset classes

- View and manage portfolios of financial assets

- Quantify risk of financial assets

- View nonfinancial assets and their valuations

- Manage payments according to PSD2 directives

Middle Office Functions

- Calculate commissions

- Calculate performances

- Create and manage registry of illiquid assets

- Manual input of valuations from third sources

- Verify compliance with respect to investment policies, MIFID and FINMA regulations and limits (supports MiFID single-name and portfolio approach)

- Create and manage Model Portfolios ( changes due to Asset Allocation committee decision are all logged) for finanial assets

- Verify correctness of Model Portfolio allocation vs. investment policies, MIFID parameters, tactical asset allocation, etc

- Set up and manage FIX technical connections

- Download data from banks (via custom interface or PSD2 APIs)

Front Office functions

- Monitor on RT basis all the portfolio values (quantities, PL, exposure)

- Rebalance single or bulk portfolios from the Model Portfolio allocation

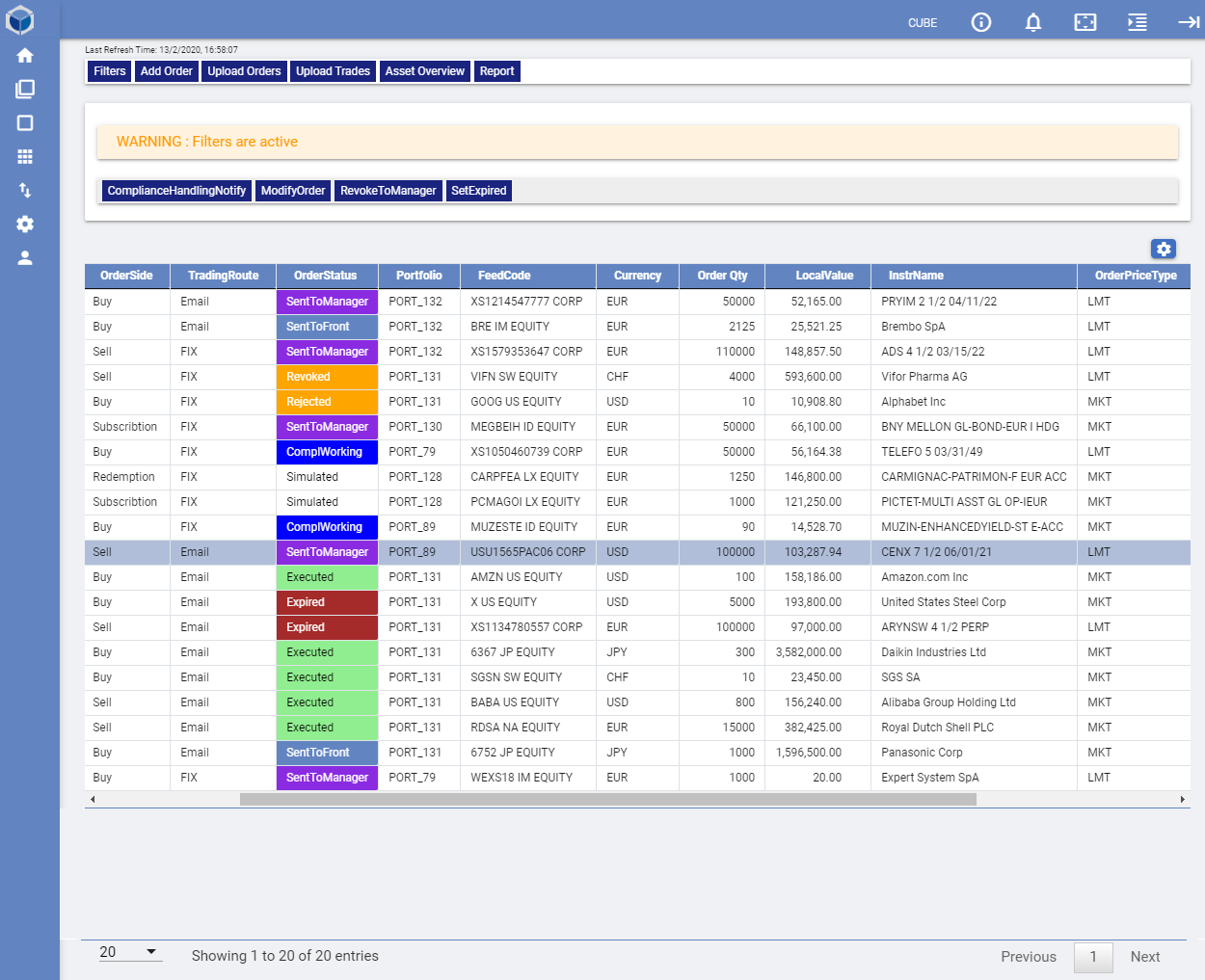

- Generate orders and transmit them to the custodian banks, by email or FIX protocol (currently supported: 4.2, 4.4)

- Monitor the status of the order book

CRM functions

- Profile prospect clients: KYC, AML, PEP, etc

- Create and manage Risk Profile questionnaires

- Calculate the client Risk Scoring

- Create and calculate client risk profiles according to MiFID and FINMA

- Assign Portfolio Management line based on Risk Profile scoring

- Manage client exceptions to Portfolio Management line

*Note: functions as shown above are typical of larger or more structured organizations. However, the User / Role /Restrictions matrix enables the creation of any number of roles based on e.g. internal or regulatory directives, company size, “chinese wall” requirements, etc.