Context of use of Cube Platform

Banks offering Investment Banking and Capital Markets services that require real-time collection (Drop Copy, FIX) and post trade risk management of trading flows.

Company functions involved

Risk Management, Trading Operations

Risk Management functions

The Cube Risk Dashboard allows

- Proprietary, in-house data and customer positions to be pushed to Cube Risk Dashboard

- View real-time risk data, refreshed after each single execution

- View commingled proprietary + Cube Risk analytics

- Setting of limits and thresholds on all available indicators

- Flexible setup of dashboard panels per single user

- Implementation of custom risk metrics to cover in house risk requirements

- Viewing of hybrid indicators built from proprietary data + Cube Risk calculations

- Pushing data calculated by Cube Risk via API to other in-house applications and to third parties

- Flexible data aggregation (e.g. per single client/ portfolio, security, underlying, etc

- Instant alerting to multiple recipients via email, text messages, according to multiple criteria (market data, preset limits, dynamic triggers, etc)

- Listed derivatives real-time margin calculations using the native Clearing House methodology

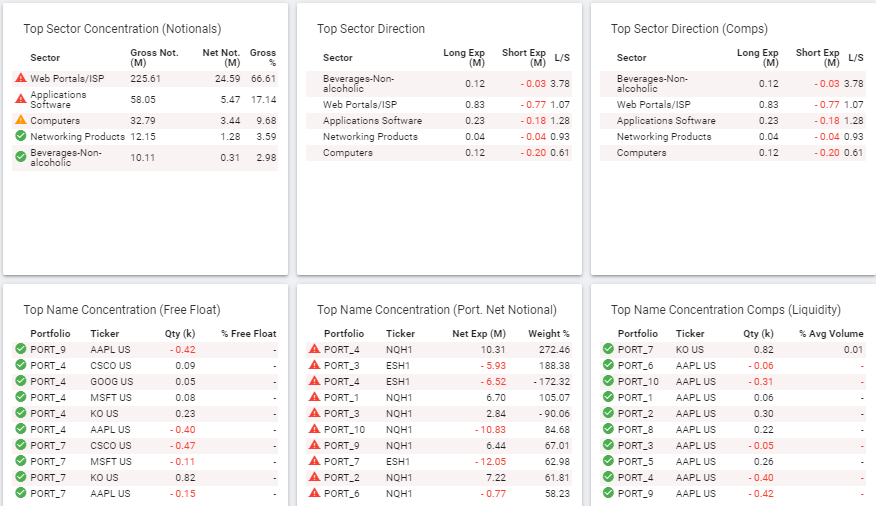

Indicators: net and gross exposures (by client or security), single security trading frequency, price deviation, concentration risks (vs. free float, market volume, portfolio holdings, etc), real-time credit line use, instant realized and unrealized P/L calculation, long-short positioning, residual unhedged exposure (including effect from futures, options, inverse ETFs).

Further custom indicators can be rapidly built as needed.

Data Connectivity

- Drop Copy (FIX) access to client execution flows

- High capacity – thousands of messages/sec.

- Streamline and concentrate connectivity from multiple markets / exchanges / brokers to one single data flow

- On premises or Cloud installation

*Note: The User / Role /Restrictions matrix enables the creation of any number of roles based on e.g. internal or regulatory directives, company size, “chinese wall” requirements, etc.