Context of use of Cube Platform

An authorized External Asset Manager managing the portfolios of private customers deposited with custodian banks

Company functions involved

Front Office, Back Office, Compliance, Risk, CRM.

Portfolio Management functions

- Create grouped orders per Investment Line or according to other criteria

- Calculate order quantities based on portfolio value (increase pct, decrease pct, fixed target, etc)

- Create allocation forecasts from simulated orders

- Rebalance single or bulk portfolios from the Model Portfolio allocation

- Create and manage Model Portfolios ( changes due to Asset Allocation committee decision are all logged)

Other Front Office functions

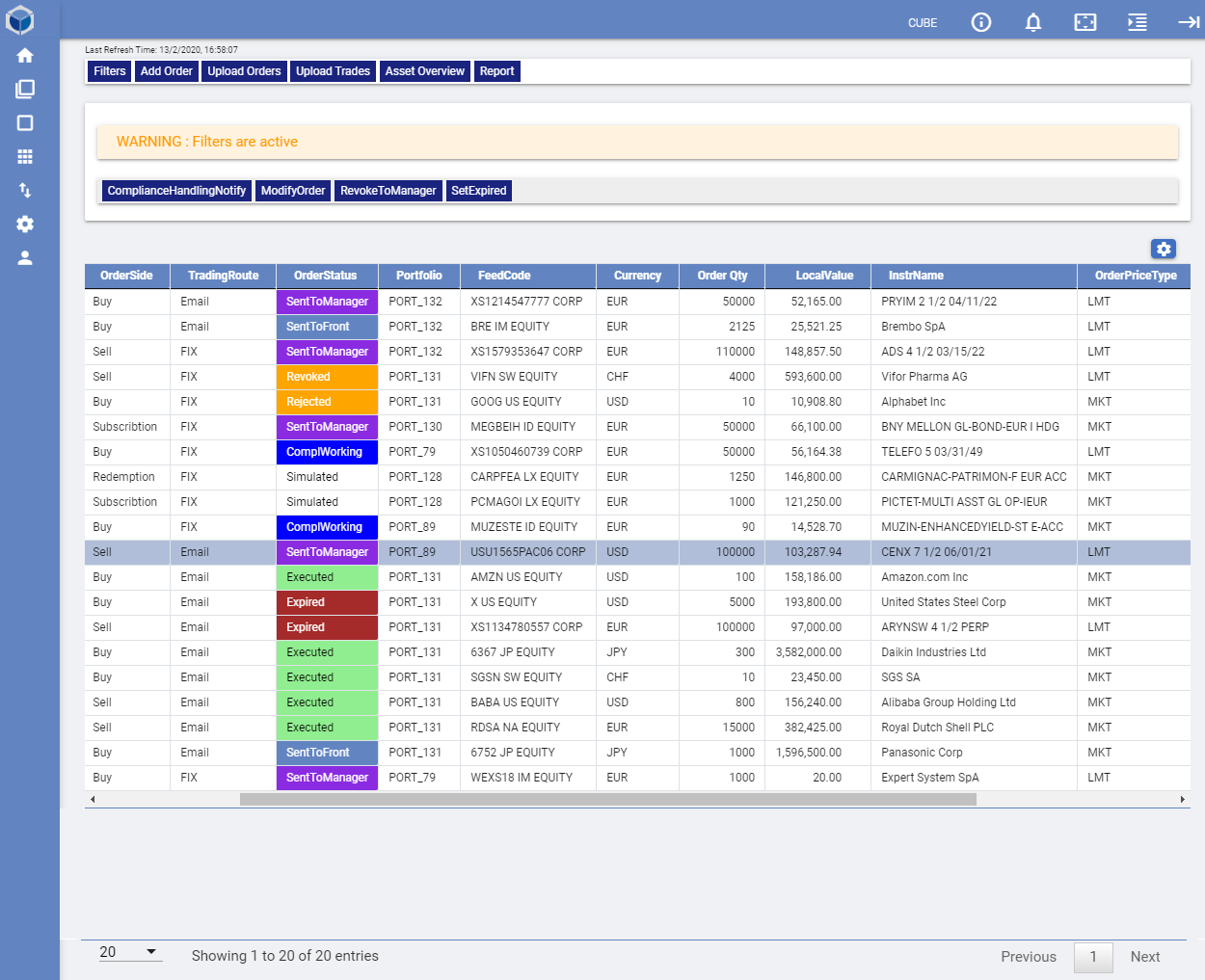

- Generate orders and transmit them to the custodian banks, by email or FIX protocol (currently supported: 4.2, 4.4)

- Pre-trade compliance (investment lines, exceptions, liquidity, short-selling, etc)

- Monitor the status of the order book

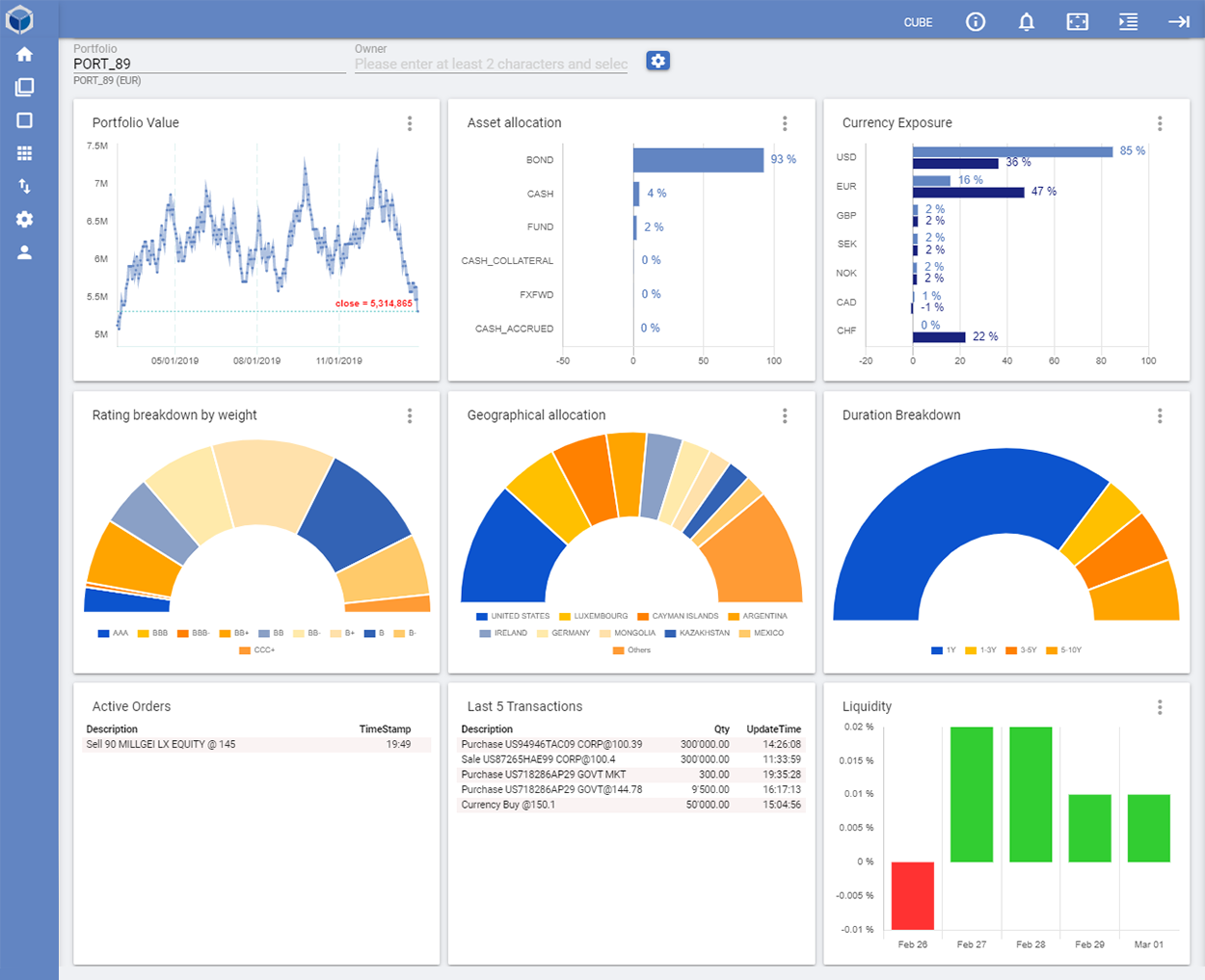

- Monitor on RT basis all the portfolio values (quantities, PL, exposure)

- Rollover of FX FWD deals according to currency limits and cash balances

Middle Office Functions

- Calculate commissions

- Calculate performances (TWR, MWR)

- Performance contribution (also per single asset over all portfolios)

- FX performance contribution

- Calculation of rebates with splitting to internal producers

- Create and manage directory of commercial counterparties / fund distributors and rebate rates

- Verify compliance with respect to investment policies, MIFID and FINMA regulations and limits (supports MiFID single-name and portfolio approach)

- “4 eye”approach is supported

- Verify correctness of Model Portfolio allocation vs. investment policies, MIFID parameters, tactical asset allocation, etc

- Set up and manage FIX technical connections

- Creation and management of Investment Policies

- Creation of Custom Asset Classes

- AML controls

- Cash (liquidity) forecasting

- Current account statements

Back Office Functions

- Receive the portfolio data from various depositary banks, the reference and market data from various data provider (Bloomberg, Reuters, Telekurs, others).

- Manage or create all type of transactions

- Reconcile the transactions and the positions of all portfolios

- Create or modify any dictionary data (instruments, portfolios, counterparties, contacts, asset classes)

- Automatically create security data from Data Provider, or manually

- Import MiFID Target Market (ETM) security data via csv / xls files

CRM functions

- Profile prospect clients: KYC, AML, PEP, etc

- Create and manage Risk Profile questionnaires

- Calculate the client Risk Scoring

- Create and calculate client risk profiles according to MiFID and FINMA

- Assign Portfolio Management line based on Risk Profile scoring

- Manage client exceptions to Portfolio Management line

*Note: functions as shown above are typical of larger or more structured organizations. However, the User / Role /Restrictions matrix enables the creation of any number of roles based on e.g. internal or regulatory directives, company size, “chinese wall” requirements, etc.