Context of use of Cube Platform

A Brokerage Company who provides broker services on ETD instruments to private clients needs to manage all the second-level Risk Management processes

Company functions involved

Listed Derivatives (ETD) Desk, Risk Manager, Credit Office

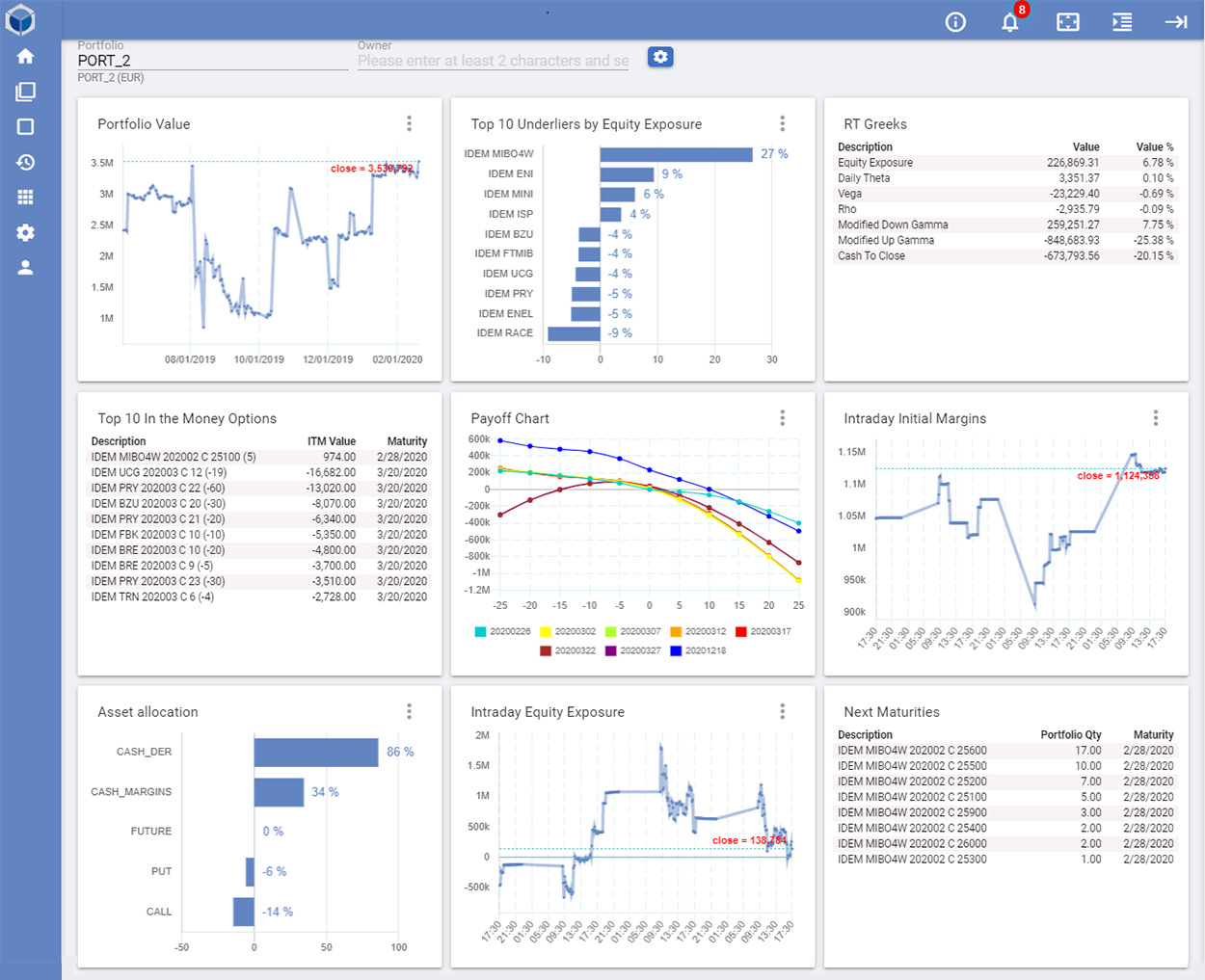

Through the Front-office module you can

- Monitor on RT basis all the portfolio in Margin Call

- Monitor on RT basis all the portfolio values (qty, PL, exposure)

- Make the margins pre-trade check

- Simulate any effect of virtual positions on current portfolios

- As consultance service help the customer to reduce the required margins

- As consultance service help the customer to reduce any type of risk (Delta, Gamma, Vega, Value at Risk)

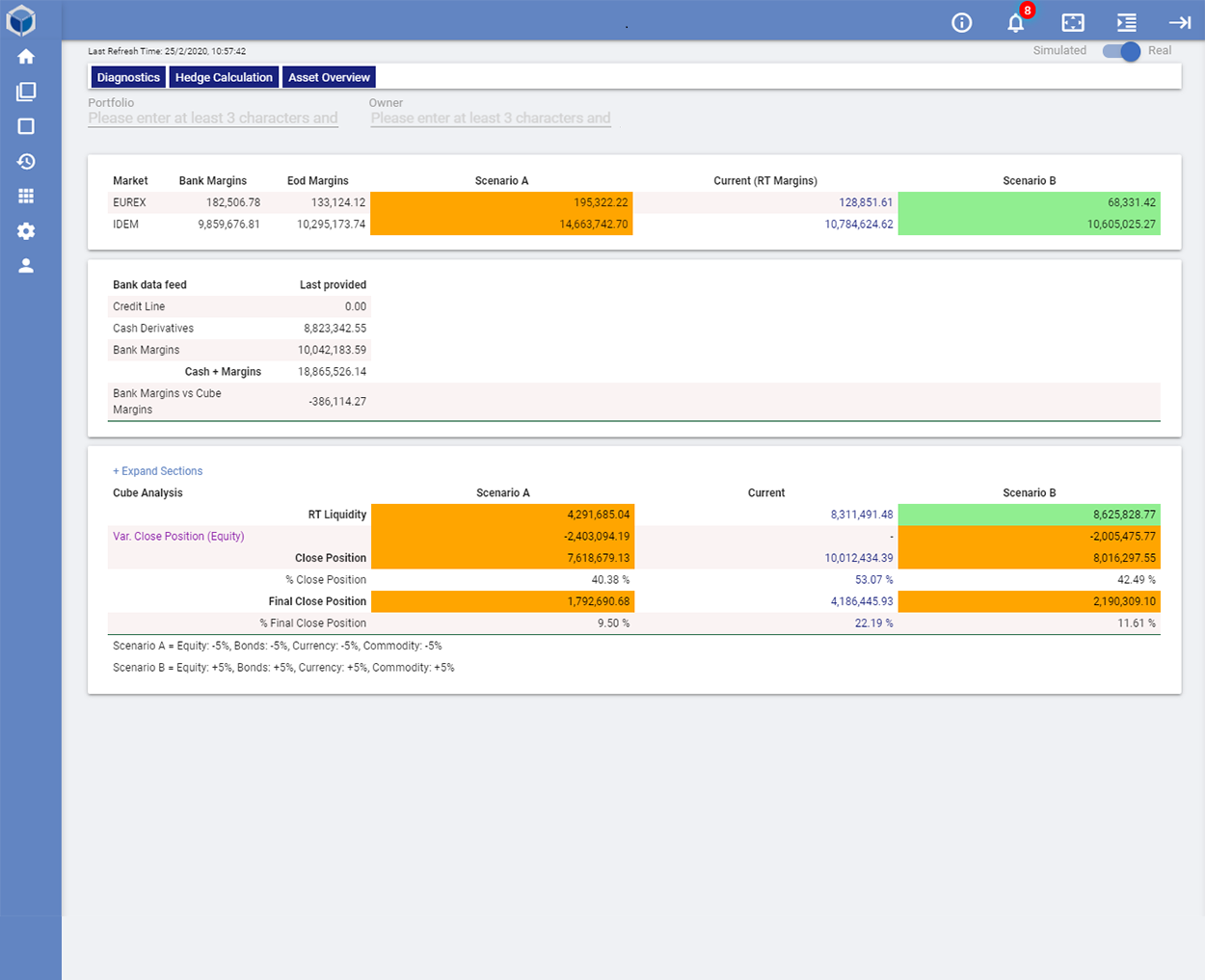

Through Risk Management module you can

- Make Scenario Analysis on all portfolios and thus recognize which of them are potentially at serious risk

- Monitor on RT basis the post-trade operational limits set by the bank on all portfolios and thus recognize which of them are in breach

- Monitor on RT basis the post-trade Value at Risk

- Calculate the portfolio Value at Risk with various models (Parametric, Historical Simulations and their sub-versions)

- Test the VaR model used through Back Test process and validation

- Make Stress Test Analysis