Context of use of Cube Platform

A UCITS Management Company that needs to manage all its investment processes.

Company functions involved

Front Office, Back Office, Risk Manager, Compliance, External Advisors

Fund Manager / Advisor functionalities:

- Create orders

- Calculate order quantities based on portfolio value (increase pct, decrease pct, fixed target, etc)

- Create allocation forecasts from simulated orders

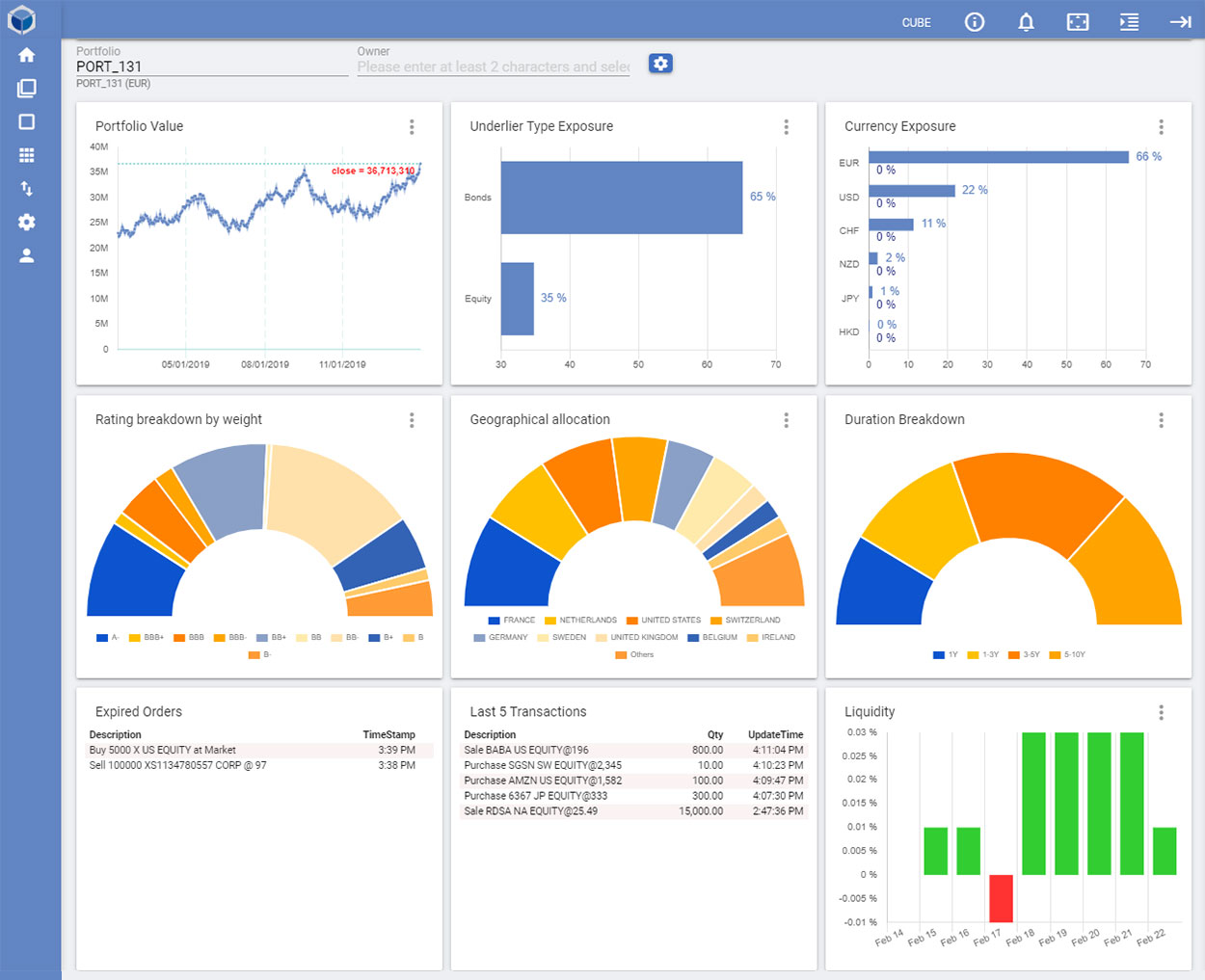

- Monitor on RT basis all portfolio values (qty, PL, exposure)

- Simulate any effect of virtual positions on current portfolios

- View Order book (Advisor restricted to own sub-funds)

- Calculate performances and performance contributions

Front office functionalities:

- Manage the entire life-cicle of the orders, from its generation to their fill

- Send/receive orders to/from brokers automatically via FIX (EMSX, TSOX, FIX hubs)

- Make the compliance pre-trade check

- Monitor on RT basis all the portfolio values (qty, PL, exposure)

- Simulate any effect of virtual positions on current portfolios

Risk Management functionalities:

- RT monitoring of post-trade compliance (regulatory: Ucits, Aifmd and the funds prospectus)

- “4 eye” compliance operations supported

- RT monitoring of post-trade Value at Risk

- View Risk metrics for all subfunds

- Calculate the portfolio Value at Risk with various models (Parametric, Historical Simulations and their sub-versions)

- VaR back test process and validation

- Scenario Analysis

- Stress Test Analysis

- Creation and management of Investment Policies

- Creation of Custom Asset Classes

Back-office functionalities:

- Receive the official portfolio data from various depositary banks, the reference and market data from various data provider (Bloomberg, Reuters, Telekurs, others).

- Manage all type of transactions

- Reconcile the transactions and the positions

- View or modify dictionary data (instruments, portfolios, counterparties, contacts, asset classes)

- Automatically create security data from Data Provider, or manually

- Calculation of rebates to fund distributors and placing agents

- Create and manage the directory of commercial counterparties / fund distributors and rebate rates

- Calculate the soft NAV